In the high-risk wellness industry, payment processors often entice merchants with low rates that seem too good to pass up. While these offers may seem enticing, the reality is that hidden fees can quickly turn a “great deal” into a financial disaster.

The Kratom Seller Story

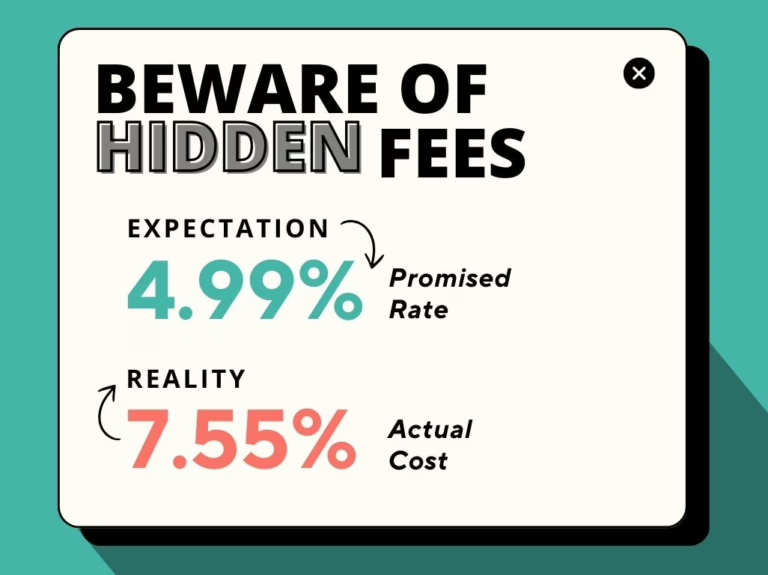

Let’s take the case of “Kratom Wellness”, a growing merchant in the wellness space, that was approached by a processor called “Tuna Payments.” Tuna promised a competitive rate of just 4.99%, which seemed very tempting for their business.

However, months later, the team at Kratom Wellness discovered that their true costs were far higher. On top of the advertised rate, Tuna had quietly added card association fees, pushing the actual rate to 7.55%. The problem? These extra charges were buried in overly complex statements—or not disclosed at all.

By the time Kratom Wellness realized what was happening, they had already lost thousands of dollars to hidden fees.

The Hidden Cost of Low Rates

The Kratom Wellness experience is not unique. Many processors use this bait-and-switch tactic, luring merchants with low rates only to pile on hidden fees over time. These charges often go unnoticed until the financial impact becomes significant, leaving businesses frustrated and financially strained.

Transparency Matters

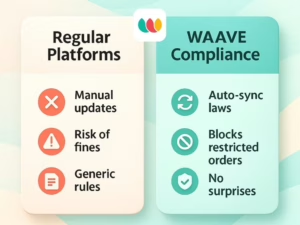

Understanding your payment processing costs shouldn’t feel like solving a mystery. Unfortunately, many processors rely on lack of transparency to extract more money from merchants. They know that most business owners are too busy running their operations to spend hours combing through convoluted statements—or may not receive statements at all.

This lack of clarity creates significant financial risk, particularly in high-risk industries where stability is critical.

The Cost of Ignorance

The allure of a low rate often comes with a heavy price. Hidden fees can quickly erode your profit margins, leaving you in a worse position than if you had opted for a more transparent, stable payment solution from the start.

A Better Way Forward

WAAVE offers a refreshing alternative. We provide full transparency in pricing, clear statements, flat fees that includes all processing costs, and a commitment to stable, compliant payment solutions. On average, merchants save $17,000 per year when switching to WAAVE—money that can be reinvested in their business instead of lining the pockets of deceptive processors.

Don’t let hidden fees derail your business. Choose transparency, stability, and compliance.