Running a wellness business online already comes with enough challenges—tight regulations, constantly shifting state laws, and the never-ending paperwork. But for many merchants, one of the biggest roadblocks isn’t regulators. It’s payment processors.

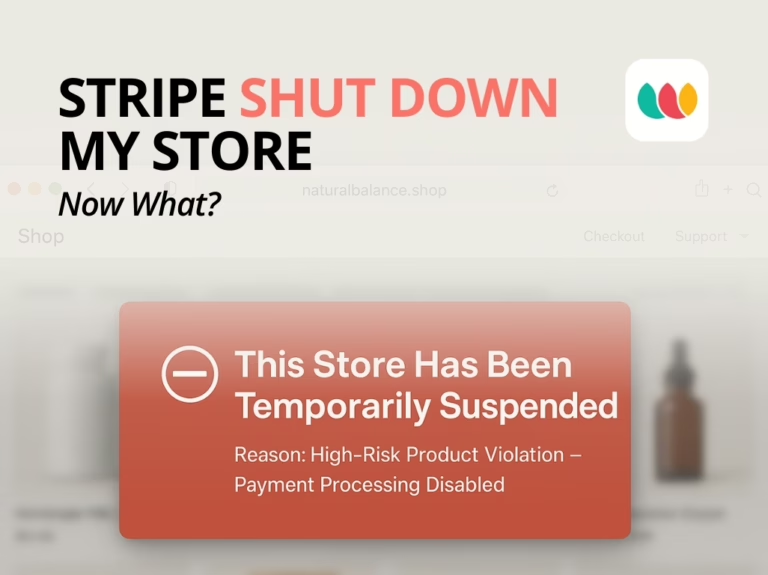

If you’ve ever had your store shut down by Stripe, Square, PayPal, or another “mainstream” processor, you know the story: business seems fine one day, then suddenly your account is frozen, your payouts are on hold, and you’re left scrambling to figure out what went wrong.

So why does this happen—and more importantly, what can you do about it?

Why Stripe and Other Mainstream Processors Block Stores

Stripe, PayPal, and similar platforms are built for low-risk, mainstream retail. Hemp, CBD, kratom, vapes, and other wellness products don’t fit neatly into that category. Even though some products are legal, payment processors classify it as “high-risk” because of:

- Regulatory complexity: Rules vary not just state-to-state but sometimes city-to-city.

- Chargeback exposure: Wellness products are sometimes linked to higher refund or dispute rates.

- Bank pressure: Stripe’s banking partners often impose their own restrictions, which leaves wellness sellers vulnerable to sudden account terminations.

The result? Even a compliant business can get caught up in broad bans that don’t take individual sellers into account.

The Risks of Getting Dropped Mid-Sale

When Stripe (or any mainstream processor) shuts you down, it isn’t just frustrating—it’s disruptive:

- Frozen funds: Your payouts may be held for months while your account is reviewed.

- Customer trust issues: Failed payments or downtime can drive buyers to competitors.

- Business continuity problems: Without a way to process transactions, your store grinds to a halt.

That’s why wellness merchants need to think carefully about choosing a payment partner built for regulated industries—not just for today, but for long-term stability.

What To Do Next

If Stripe shut down your store, here’s the practical next step:

- Don’t panic. This happens to many sellers—it’s not necessarily about your business practices.

- Document everything. Keep records of your COAs, licenses, and compliance files. You may need these for future banking partners.

- Switch to a processor that specializes in regulated wellness industries. The right partner won’t just look at KYC data—they’ll review your products, verify COAs, and ensure you’re aligned with federal and state laws. This helps protect both your revenue and your reputation.

A Smarter Path Forward

Getting dropped by Stripe is a setback, but it doesn’t have to be the end of your business. Wellness sellers who want real continuity need a processor that was built with compliance at its core.

That’s where WAAVE comes in. Unlike mainstream platforms, WAAVE was designed for regulated wellness industries. Every transaction runs through real-time compliance checks that go far beyond KYC—covering COAs, product rules, state restrictions, and even city-level laws. That means you can keep selling without worrying about sudden shutdowns.

Same Features. Real Compliance.

Losing Stripe doesn’t mean losing modern tools. WAAVE gives wellness merchants the same frictionless experience — with the compliance infrastructure Stripe never built for regulated industries.

Here’s what you still get with WAAVE:

Full Merchant Dashboard – Real-time transaction tracking, refunds, and payouts in one place.

Integrated Invoicing & QuickBooks Sync – Generate, send, and reconcile payments directly from your accounting system.

Customer Insights – Track buyer behavior, top SKUs, and repeat purchase trends.

Instant Notifications – Get alerts for payments, disputes, and compliance flags as they happen.

With WAAVE, you don’t have to choose between innovation and legality — you get both.

If Stripe shut down your store, the next step is clear: choose a payment partner that understands your business and protects it for the long run.